Why Appoint an Investment Manager?

Emotions play a surprisingly significant and somewhat underappreciated role in investing, as investors can easily fall prey to common human cognitive and psychological biases that often lead to poor investment decisions. As such, successful investing requires investors to have an appreciation for, and control over, their feelings which is not an easy feat. Some of the most common biases are:

Loss aversion: the observation that human beings experience losses asymmetrically more severely than equivalent gains. This overwhelming fear of loss can cause investors to behave irrationally and make bad decisions, such as holding onto investments for too long or too little time as they strongly prefer avoiding losses than obtaining gains.

Overreaction: investors and markets overreact to unexpected and dramatic news events. Empirical evidence shows that the overreaction is larger for negative reactions than positive. This can result in unmeasured and disproportionate responses trying to time market events and a deviation from investors’ long-term goals.

Overconfidence: the existence of confirmation bias, a natural human tendency to seek or emphasise information that confirms an existing conclusion or hypothesis, results in investor overconfidence. This can result in increased risk taking and a false sense of security.

Herding: investors follow the actions and decisions of larger groups, assuming they know something they don’t. This often results in them ignoring their own analysis or rational thought and causing them to abandon their own strategies in favour of following the crowd.

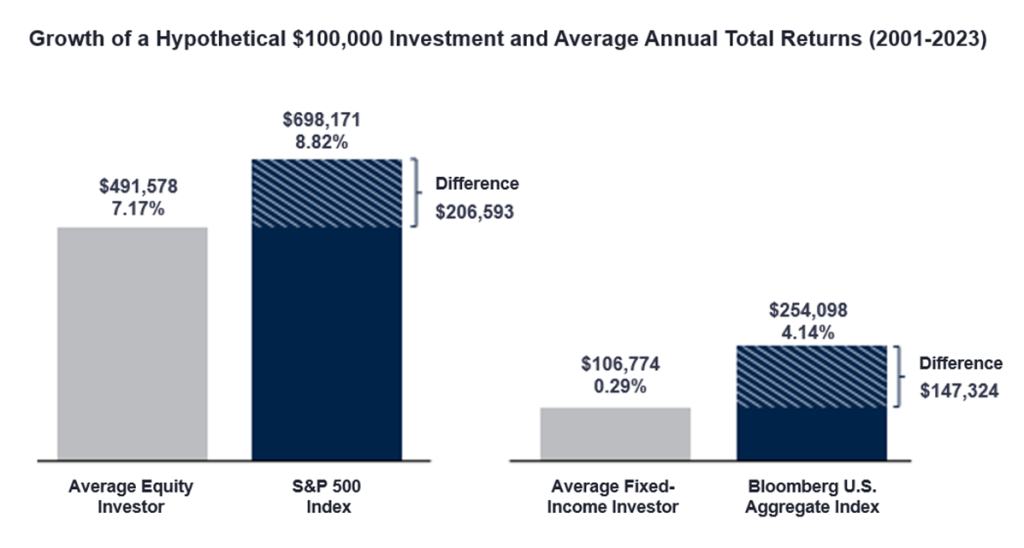

A study by DALBAR, a financial research firm, has shown that these common self-investor behaviours and the temptation to time markets have caused average investor results to significantly lag the broader markets over a 20-year time span, as shown in the graph below.

By appointing a discretionary manager, you avoid these behavioural biases by delegating the investment decision making to an expert.

More importantly, you have access to a dedicated advisor who can guide you through market uncertainty and keep you on track to achieving your long-term goals by staying invested.

Click here to contact us today to arrange an initial consultation call with us to see how we can support you in avoiding these behavioural biases and help you achieve your financial goals.

Source: DALBAR. Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested.