The Power of Time in the Market, Not Timing the Market

At Sigma Private Office, we’ve always believed in the fundamental truth that time in the markets is far more important than timing the markets. For investors, this principle isn’t just a strategy; it’s a mindset — a cornerstone of disciplined wealth management.

In a world where fast-paced news cycles, social media, and a constant barrage of financial expert opinions can make the markets seem unpredictable, it’s easy to feel the pressure to time your investments perfectly. But the reality is, the most successful investors rarely try to “time” the market. Instead, they focus on time in the market. Within this article we explore why this approach is so powerful, and how it can help you build lasting wealth.

The Myth of Timing the Market

The allure of “timing the market” is understandable. We all want to make investments at the right moment, when prices are low and poised to rise, or when the market is on the cusp of a breakthrough. However, consistently predicting market highs and lows is incredibly difficult, even for the most seasoned of investors. Studies have shown that trying to time the market with precision often leads to missed opportunities, particularly when it comes to the compounding growth that happens over time.

Market timing is, in essence, about trying to predict short-term fluctuations. But no one can consistently forecast what will happen tomorrow, next week, or next month in the market. The most successful investors know this, and they’ve built their strategies around long-term thinking, which is why this is one of our core investment principles.

The Importance of Staying Invested

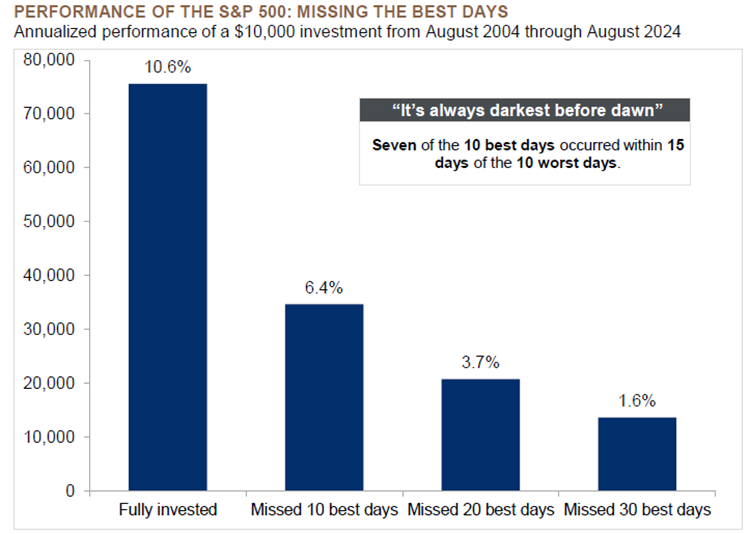

A simple yet powerful truth is that the stock market, despite its ups and downs, has historically trended upward over time. By staying invested through both the good times and the bad, investors benefit from the long-term growth potential of markets. In fact, missing just a few of the best-performing days in the market can significantly reduce long-term returns. According to research, the S&P 500’s total return over decades is driven by a relatively small number of extraordinary days. If you’re out of the market when those days happen, whether by selling in a panic or trying to time a “better” entry point, you miss out on some of the best opportunities for growth.

For example, in the chart below from JP Morgan you can see the annualised performance of a $10,000 investment from August 2004 through August 2024. The investor capable of staying fully invested over that period achieved an annualised return of 10.6%. An investor, that just missed 10, 20 or even 30 of the best days significantly reduced their returns in comparison. This is because over the last 20 years, seven of the 10 best days occurred within 15 days of the 10 worst days.

The key takeaway here is simple: stay invested. Fear may push investors out of the market during bouts of volatility, causing them to miss the strong rebound on the other side.

The Role of Patience and Discipline

Investing is a marathon, not a sprint. While short-term market volatility can be unsettling, it’s essential to maintain a long-term perspective. The market’s ups and downs are inevitable. But history shows that, over time, periods of growth tend to far outweigh periods of downturn in time and magnitude. Patience and discipline are your allies here, staying the course in both good times and bad is the key to successful investing. In a recent article we discussed the importance of appointing an Investment Manager due to some of the human cognitive and psychological biases which can lead to poor investment decisions, you can read more about this here – Why Appoint An Experienced Investment Manager – Sigma Private Office.

One of the core principles we champion at Sigma Private Office is building an investment strategy that aligns with your long-term goals, risk tolerance, and financial objectives. Whether you’re focused on growth, income, or preservation of wealth, your strategy should be designed to weather market volatility and take advantage of the compounding returns that accrue over time.

Why Sigma Private Office Focuses on Time in the Market

Our Investment Committee at Sigma Private Office possesses extensive investment experience and knowledge. This experience has taught our team the importance of taking a long-term approach to investing, believing in time in the markets, not timing the markets. Hence this being one of our core investment principles.

Our active, high-conviction direct strategies focus on holding quality assets to maximise the effects of compounding growth and generate alpha for our clients.

In Conclusion: Invest for Time, Not Timing

Successful investing isn’t about trying to outguess the market. It’s about investing with time on your side, taking advantage of the long-term growth potential of the market, and allowing your wealth to grow through compounding returns. At Sigma Private Office, we’re committed to helping our clients adopt this philosophy, one that builds wealth slowly and steadily over time, with the discipline, experience and patience needed to weather market fluctuations.

As you think about your own investing strategy, ask yourself this: Are you focusing on time in the market, or are you getting caught up in the temptation of market timing? The answer could make all the difference in the wealth you build for yourself and your family.

By keeping your eyes on the long-term horizon and staying invested, you’ll be positioning yourself to benefit from the market’s natural upward trajectory. At Sigma, we’re here to help you navigate that journey with confidence and clarity.

- Source: J.P. Morgan Asset Management analysis using data from Morningstar Direct. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalisation-weighted index that measures the performance of 500 large capitalisation domestic stocks representing all major industries. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Analysis is based on the J.P. Morgan Asset Management Guide to Retirement. Data as of August 31, 2024. ↩︎