The Importance of a Long-Term Mindset When Investing

Investing can often feel like an emotional rollercoaster, with economic uncertainties, geopolitical events and investor sentiment causing short-term volatility. However, history shows that those who maintain a long-term perspective tend to achieve better outcomes.

At Sigma Private Office, one of our core Investment Principles is the importance of a long-term mindset. This is a philosophy that enables our clients to build resilient portfolios, better navigate volatility and ultimately achieve their financial goals.

Therefore, within this blog, our Investment Committee share three key reasons as to why maintaining a long-term mindset when investing is so important:

Why the Long-Term Mindset Matters

Short-term market movements are unpredictable. The press is often filled with dire warnings about market downturns, recessions, and crises. Yet, over the past century, markets have continued to rise despite wars, economic crashes and global pandemics.

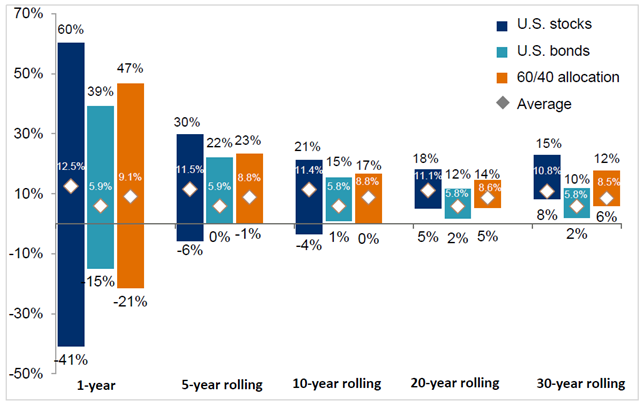

A recent J.P. Morgan Private Bank study from 2024 reinforces this point, showing that while markets can have bad days, weeks, or even years, history shows that investors who stay the course are far less likely to experience losses over extended periods. J.P. Morgan’s research, which tracks the best, average and worst 1-, 5-, 10-, 20-, and 30-year rolling periods from 1950 to the end of 2024, also found that while one calendar year’s returns varied widely, a diversified 60/40 portfolio (stocks and bonds) has never suffered an annualised negative return over any ten-year rolling period in the past 70 years, see chart below.

The Power of Time in the Market, Not Timing the Market

At Sigma Private Office, we’ve always believed in the fundamental truth that time in the markets is far more important than timing the markets. For investors, this principle isn’t just a strategy; it’s a mindset — a cornerstone of disciplined wealth management.

One of the most damaging investment mistakes is attempting to time the market, trying to jump in and out of investments based on short-term market predictions. Markets move in cycles, and some of the best days often occur immediately after the worst ones; over the last 20 years, seven of the 10 best days occurred within 15 days of the 10 worst days. As such, investors who panic and sell during downturns often miss the rebound, significantly reducing their long-term returns.

For more information on this, as well as the power of compounding, you can see our recent blog titled ‘The Power of Time in the Market, Not Timing the Market’ here.

Practicing Diversification and Patience

At Sigma Private Office, our investment philosophy emphasises the importance of patience and maintaining a long-term perspective. We work closely with our clients to develop tailored investment strategies that align with their unique goals and risk tolerance levels. A well-diversified portfolio helps smooth returns and mitigate risk.

Markets will have bad years, but history suggests that long-term investors are rewarded for their patience. You can read more about this and how to overcome common behavioural biases inherent in investing in our blog titled ‘Investing Amid Market Volatility and Economic Uncertainty’ here.

In addition to this, keep the time horizon of your goals in mind. If you need the money in a year, you should have a very different portfolio than if you don’t need the money for twenty years.

In Conclusion: Maintain a long-term mindset to navigate markets effectively

By maintaining a long-term mindset when investing and adhering to some of these key investment principles, we aim to navigate market volatility and capitalise on opportunities that arise over time. Our disciplined approach is designed to help our clients achieve their financial objectives while managing risk effectively.

Sources: Barclays, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are rolling monthly returns from 1950 to June 30, 2024. Stocks represent the S&P 500 Shiller Composite, and Bonds represent Strategas/Ibbotson government bonds for periods from 1950 to 2017, then Bloomberg Finance L.P. Barclays U.S. Treasury Total Return index from 2017 to 2024. 60/40 portfolio is rebalanced monthly and assumes no cost. Data as of January 2, 2025.

Outlooks and past performance are no guarantee of future results. It is not possible to invest directly in an index.