Sigma Private Office’s Investment Committee Share Some Truths About Investing at All Time Highs

After this summer’s market volatility, global equity markets are trading back at all-time highs, and we thought it timely to revisit an article we wrote back in March. The S&P 500 has now notched 47 new all-time highs this year alone, understandably causing a renewed sense of nervousness among some investors. The questions of “is now a good time to invest” and “are equities too expensive” are once again frequent in the current market environment. However, a look back through history suggests it is as good a time as any to invest and traditional valuation metrics like the price-to-earnings (P/E) ratio are not predictive of equity market returns.

In Chart 1 we see the numerous all-time highs the S&P 500 has reached over the decades; the same goes for other equity indices globally. This sustained upward momentum, driven by continuous economic development and earnings growth, paves the way for subsequent peaks.

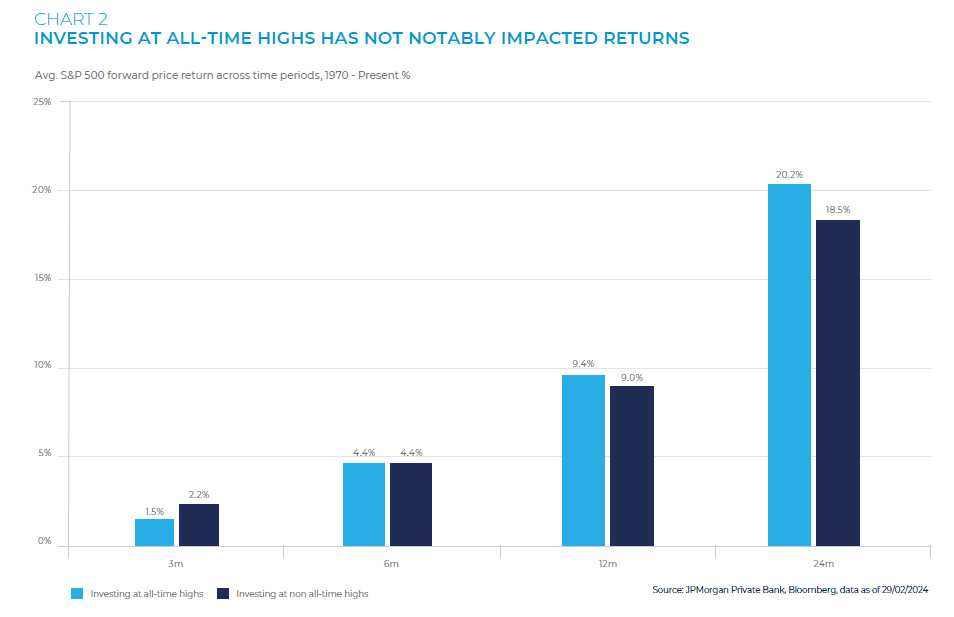

Furthermore, empirical evidence, as outlined in Chart 2, illustrates why investors should not fear investing at perceived market highs. Contrary to common misbeliefs, returns are near identical when investing at all-time highs versus investing at any other time. In other words, it is not about the timing of your investments so much as it is about being invested, something we so often talk about.

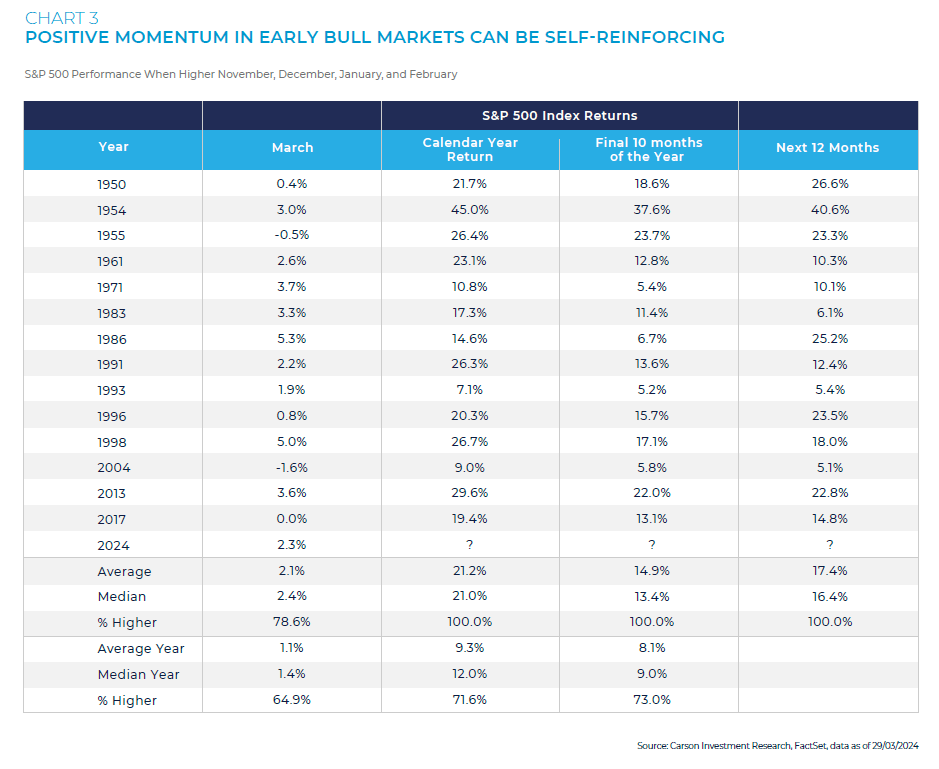

The strong equity market returns over the past two years also raises the worry among some investors that they have missed all the upside or that a correction must be “just around the corner”. However, the reality is that corrections cannot be timed as they can occur at any given point throughout a bull market, on average occurring once a year. As we saw in July, following the Japanese Yen carry trade unwind, corrections typically require a catalyst whereby sentiment unexpectedly sours. Moreover, corrections don’t derail bull markets and investors tend to underestimate the strength of positive momentum and its self-reinforcing nature, allowing markets to continue their upward trajectory even after periods of robust gains. Chart 3 demonstrates this ongoing strength in S&P 500 returns in the months following gains in all four months from November to February. With two months to go, this year seems to be on track with this trend, but we’ll have to wait and see what the remainder of this year has in store for us.

Adding to the already long list of investor concerns, the S&P 500’s forward 12m P/E ratio remains above 20x, bringing discussions around market (over)valuation to the forefront. However, concentrating on valuation metrics alone is an oversimplified way of determining if a stock is cheap or expensive and does not determine the future direction of the stock price.

Moreover, a forward P/E ratio has inherent limitations as it is based on analysts’ expectations of future profits, not past earnings, which the market has already assimilated into stock prices. As such, high forward P/Es often surface when earnings estimates are conservative, and the market is already anticipating a rebound. Therefore, during the early stages of a bull market for example, forward P/Es might appear inflated not because stocks are overvalued but because analysts are recalibrating their earnings projections to catch up with the market’s recovery trajectory.

Ultimately, all that really matters for a long-term investor is determining and maintaining the correct investment strategy that is aligned with your risk tolerance and financial objectives, irrespective of the pursuant market environment. Rather than attempting to time the market or react to short-term volatility, a disciplined approach that leverages the power of compounding returns is more likely to yield success. In knowing this, you can look beyond immediate market conditions and focus on the long-term growth that has characterised equity investing over many decades.