Quarterly Market Review & Outlook Q3 2024

In moves that somewhat mimicked the summer of 2023, the third quarter experienced a fresh bout of volatility after a strong start to the year. Global equity markets faced a turbulent summer, dropping ~8% from mid-July to early August before staging a powerful rally to recover those losses. New all-time highs were briefly reached before markets pulled back sharply at the start of September on renewed recession fears as the S&P 500 had its worst week since the regional banking scare of early 2023.

The quarter closed out with the MSCI World Index up 6.2% in Q3 and 19.3% year to date, trading at new all-time highs. Despite the spotlight shining on the state of the US economy, US equity markets continued to outperform their European counterparts with the S&P 500 up 20.81% year to date vs the Euro Stoxx 600 which is up 9.17% year to date in local currency terms.

The July sell-off was largely caused by the sudden appreciation of the Japanese Yen, on the back of a policy shift by the Bank of Japan. This led to the unwinding of popular ‘carry trades’, in which investors had borrowed at lower rates in Japan to fund purchases of higher-yielding assets abroad, notably the US. Simultaneously, US economic data releases for July highlighted a weakening labour market with the unemployment rate rising to 4.3%, triggering the ‘Sahm rule’ (identifies signals related to the start of a recession when the three-month moving average of the unemployment rate rises by 0.50% or more relative to its low during the previous 12 months), a closely watched recession indicator. This flurry of events resulted in a drastic repricing of risk assets as markets adjusted their expectations for an increased number of rate cuts by the Federal Reserve.

As is typical in corrections, sharp moves lower that are sentiment driven, quickly reverse on the realisation that it may not be as bad as initially feared. For one, the ‘Sahm Rule’ historically has only reliably signaled a recession when other economic indicators such as GDP growth, industrial production and retail sales have also been weak. Today, a closer look at the US economy still paints a picture of resilience. US GDP grew at an annualised rate of 3% in the second quarter as consumer spending remained solid and

corporate profitability expanded. US retail sales over the summer surprised to the upside and industrial production continued to trend flattish, which isn’t all too alarming given manufacturing only accounts for 11% of US GDP. Importantly, the services sector, which is the engine of the US economy, remains solid.

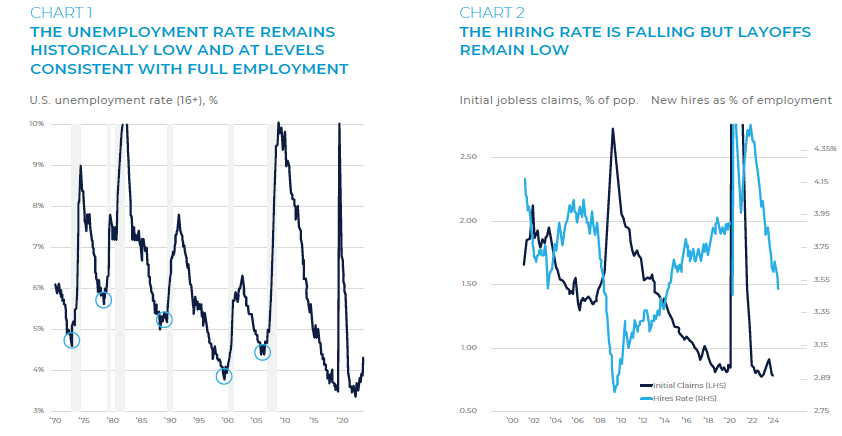

Admittedly, July and August data has highlighted the US labour market is potentially slightly weaker than thought. The unemployment rate has risen as shown in Chart 1, but it remains historically low, and the recent increases largely reflect strong labour supply from immigration rather than a substantial increase in layoffs as highlighted in Chart 2. However, the hiring rate, which is an indication of demand for labour, has slowed notably from its 2023 peak as shown by the light blue line in Chart 2.

Source: Bureau of Labour Statistics, Haver Analytics, J.P. Morgan. Data as of June 30, 2024.

Continue reading the team’s quarterly review by clicking below…

Click here to view the entire Q3 2024 Market Review & Outlook document in full, where the team also offer a deeper dive on the highly anticipated start of the Fed cutting cycle, as well as sharing an update on recent bond markets moves, this summer’s unwind of the Japanese Yen carry trade, China’s deflationary battle, elections in Europe and much more. In addition, the team offer their views on the quarter ahead, as well as a standalone thematic piece titled ‘The Sentiment Lifecycle’, a check in on where investor sentiment stands today.

Please reach out via our contact us page should you wish to discuss or speak to one of our relationship managers or dedicated investment team.