Quarterly Market Review & Outlook Q2 2024

Just halfway through the year and the S&P 500 is up 14.48%, well above its historical average for any full year, and multiple record highs have been notched. The strong start has left some investors wondering if stocks have risen too far, too quickly. History would suggest not, and we’ll explain why later, but for now we’ll start with a brief review of the developments this quarter.

Global equity markets continued to climb the wall of worry, with the MSCI World up 2.18% for the quarter and 10.81% year to date. European equity markets lagged the US, as the Nasdaq 100 reclaimed its position as the top-performing developed market index, rising 7.82% over the quarter. Strong earnings reports propelled mega-cap technology stocks higher, with Nvidia becoming the third company ever to exceed a $3 trillion market cap, temporarily surpassing Apple and Microsoft as the world’s largest publicly traded company. AI’s transformative and productivity-boosting potential continued to gain traction. Apple previewed their “Apple Intelligence,” reaffirming their place in the Magnificent 7 and climbing to new all-time highs. However, this resulted in some of the first quarter’s increased market breadth, defined as the ratio of the number of advancing stocks to declining stocks, being undone in Q2.

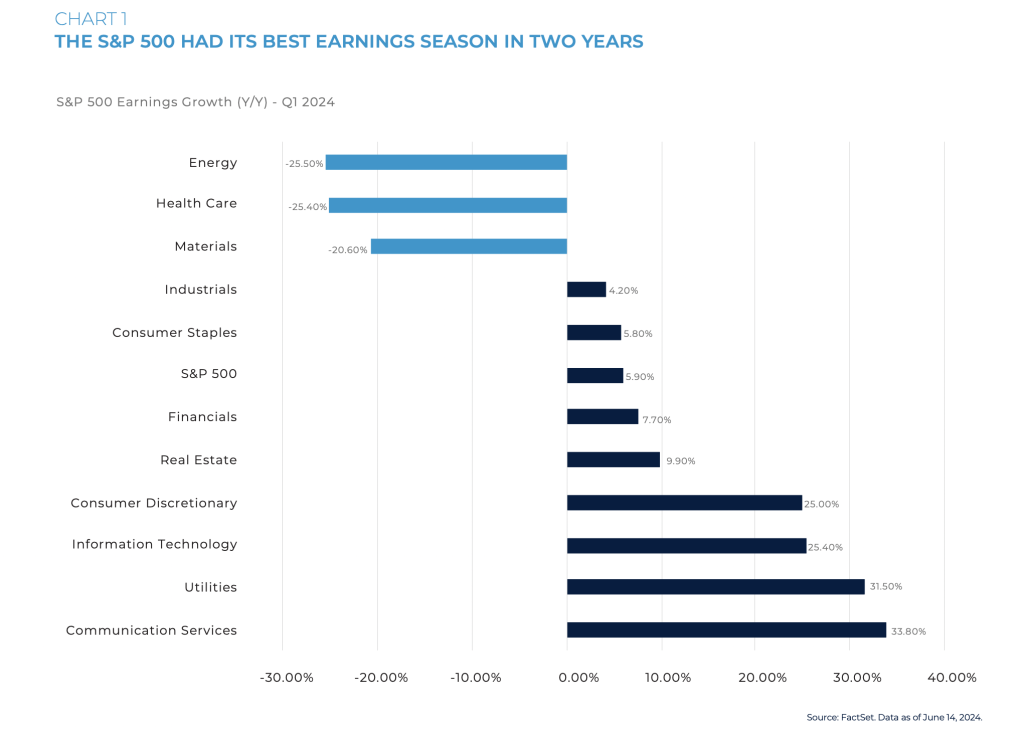

The reacceleration in earnings growth has been the main driver of equity market strength year to date, and while the tech giants have led the way, earnings have been impressive across the board. The S&P 500 had its best earnings season in almost 2 years, with all 11 sectors exceeding analyst expectations and 8 sectors posting year-over-year earnings growth as seen in Chart 1. Continued strength in earnings should be supportive for equity markets over the remainder of the year and is encouraging for a broader contribution to returns.

Continue reading the team’s quarterly review by clicking below…

Click here to view the entire Q2 2024 Market Review & Outlook document in full, where the team also offer a deeper dive on the state of the global economy and their expectations for equities and fixed income in the current higher inflation and interest rate regime. In addition to this, the team also answer the question ‘Have equities risen too far, too fast?’ and discuss the strong rally year to date as the S&P 500 hits over 30 new all-time highs. This strength continues from 2023’s young bull market rally which surprised many, but not our team, see our video on this topic here.

Please reach out via our contact us page should you wish to discuss or speak to one of our relationship managers or dedicated investment team.