Quarterly Market Review & Outlook Q1 2024

“We currently don’t foresee an urgency for rates to drop so soon and do not think the continuation of this young bull market is contingent on it.”

Sigma Private Office Investment Committee

Quarterly Review

2024 was off to another solid start as the MSCI World Index rose 8.44% in the first quarter, with most major developed market equity indices posting high single digit gains. The S&P 500 set its new longest weekly winning streak record in almost two decades, notching 9 consecutive weekly gains, whilst Japan was yet again the standout performer with the Nikkei 225 up 20.03% in local currency terms and reaching its first new all-time high in 35 years. The widespread positive momentum came despite investors dialling back interest rate cut expectations coupled with slightly hotter than anticipated inflation readings.

While equity markets took it in their stride, bond markets were less immune as US bond yields surged on strong economic data releases. Having started the year at 3.86%, the US 10 Year Treasury yield rose 50 basis points through mid-March, before retracing at the end of the quarter on optimism rate cuts were near.

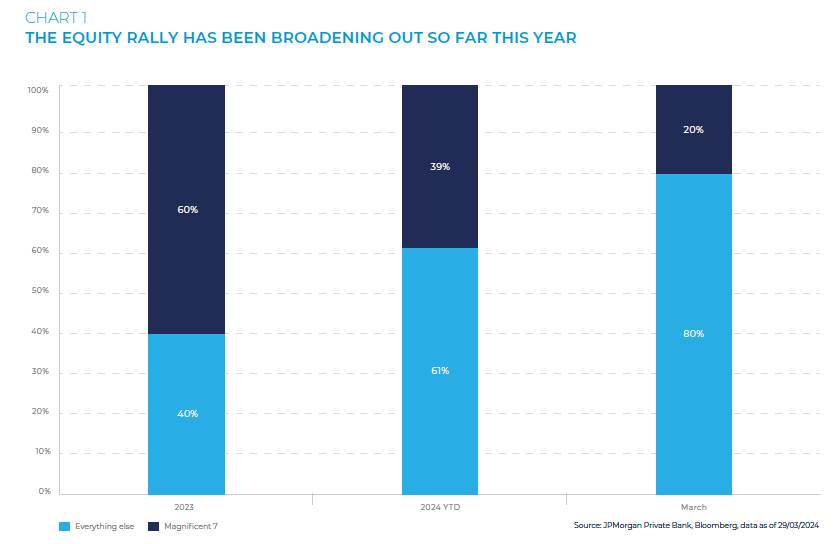

US and European equity indices climbed to new all-time highs as markets were buoyed by robust corporate earnings. Following a year of very narrow market breadth with the Magnificent 7 driving the majority of returns in 2023, we saw a wider contribution in the first quarter of 2024 as illustrated in Chart 1. US equity markets marginally outperformed their European counterparts but for the first time in over a year we saw the S&P 500 outperform the NASDAQ 100 over the quarter. Notably, the S&P 500 equal weighted index also outperformed the market cap weighted index by 1.15% in March, in a sign of widening breadth.

Continue reading the team’s quarterly review by clicking below…

Click here to view the entire Q1 2024 Market Review & Outlook document in full, where the team also discuss topics such as the Magnificent 7, Artificial Intelligence, Inflation, Interest Rates and upcoming elections. In addition to this, the team also share some truths about ‘investing at all-time highs’ and answer some of the big questions being posed, such as ‘is now a good time to invest?’.

Please reach out via our contact us page should you wish to discuss or speak to one of our relationship managers or dedicated investment team.