Investing Amid Market Volatility and Economic Uncertainty

Many investors tend to approach the stock market with the assumption of rationality; however, the reality is often quite different. Our decisions are frequently, and sometimes unknowingly, influenced by behavioural biases that affect our investment choices, which studies show is often to our detriment.

Since the summer we have seen volatility resurface and investors typically become increasingly susceptible to psychological biases, that could potentially dictate investment outcomes, in more uncertain market environments. Below we explore some of the behavioural biases that impact investing amid market volatility and economic uncertainty:

Common Behavioural Biases That Impact Investors

1. Recency Bias and Emotional Investing

One of the most common biases investors experience is recency bias—the tendency to extrapolate current trends into the future. This can lead investors to make decisions based on short-term market movements rather than long-term fundamentals.

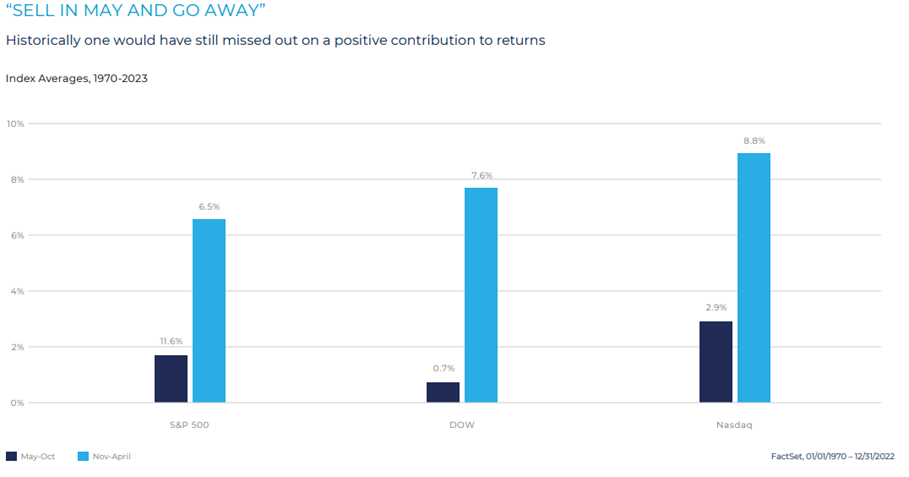

Popular sayings such as “Sell in May and Go Away” or the “September Effect” are prime examples of myths that can trigger emotional investing. These rules may have some empirical backing (see chart below titled “Sell in May and Go Away”), but they are not reliable investment strategies. Relying on these myths often leads to missed opportunities, as investors may avoid the compounding growth benefits of long-term investing.

2. Loss Aversion: Fear of Loss Over the Prospect of Gain

Another common behavioural bias is loss aversion, which refers to the tendency to fear losses more than we value equivalent gains. This bias can lead to overly cautious investment decisions, such as selling off assets prematurely or avoiding riskier, higher-return investments.

While avoiding losses is natural, it can undermine long-term growth potential if it causes investors to miss out on market rallies or overreact to market downturns.

3. Overconfidence in Investment Choices

Overconfidence is another key bias that can harm investment performance. Overconfident investing can often lead to excessive trading and higher levels of risk taking, neglecting warning signs that suggest their strategies may be flawed.

Studies show that overconfident investors tend to trade more frequently but often achieve lower returns than their less confident peers.

4. Confirmation Bias: Ignoring Contradictory Information

Another trait of overconfident investors is confirmation bias, the tendency to seek out and prioritise information that confirms one’s existing beliefs while ignoring contradictory evidence. This can lead to overconcentration in investments one believes will perform well while overlooking signs or data that suggest otherwise.

5. Managing Behavioural Biases: Self-Awareness and Discipline

While investors cannot control global trends or the policies of central banks, they can manage their reactions to these factors. The key to overcoming behavioural biases lies in self-awareness and discipline.

By recognising and controlling these biases, investors can protect their portfolios from impulsive decisions that often lead to long-term setbacks. The more aware you are of your emotional triggers, the better you’ll be able to avoid decisions driven by short-term market fluctuations.

6. The Impact of Investor Behaviour on Long-Term Performance

Dalbar’s QAIB (Quantitative Analysis of Investor Behavior) reports have long been a cornerstone for understanding how investor behaviour impacts performance. For almost four decades, these reports have shown that investors often impair their long-term returns by succumbing to short-term strategies like market timing, herd mentality, and chasing performance.

As detailed in our recent article, ‘Why Appoint an Investment Manager?’, the DALBARchart showcasing the growth of a hypothetical $100,000 investment and average annual total returns, shows that these common self-investor behaviours and the temptation to time markets have caused average investor results to significantly lag the broader markets over a 20-year time span. When investors make emotional decisions based on short-term market trends, they risk undermining their long-term financial goals.

7. Volatility and the Importance of Long-Term Investing

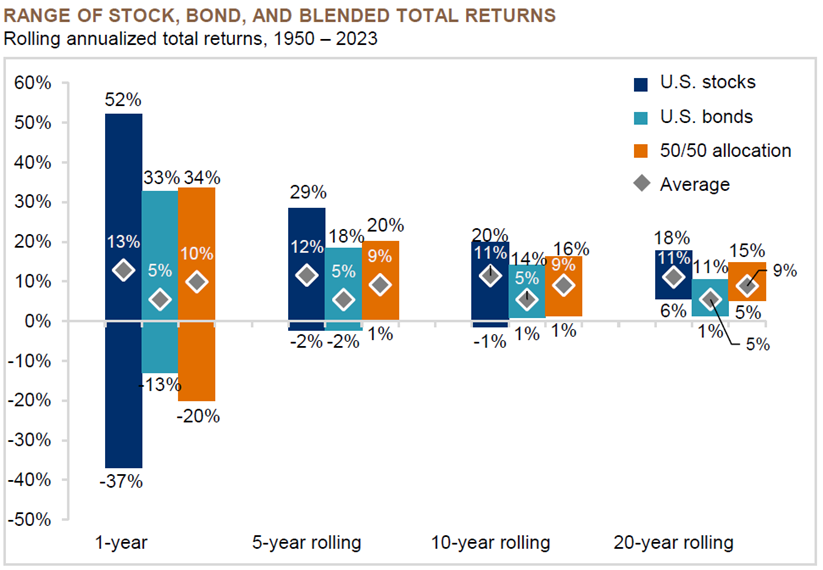

Volatility is an inherent part of investing. However, history has shown that markets trend upward over the long term. A chart by JP Morgan (June 2024), which tracks the best and worst 1-, 5-, 10-, and 20-year rolling periods from 1950 to the end of 2023, illustrates that there hasn’t been a single negative period for global stocks, bonds, or a 50/50 portfolio during these timeframes.

This reinforces the idea that the best strategy for navigating volatility is staying invested for the long term. When you have a well-diversified portfolio that aligns with your risk tolerance and long-term financial goals, you’re in the best position to weather market fluctuations.

In conclusion, to maximise returns and minimise anxiety, it’s essential to recognise and manage your behavioural biases. Maintaining a well-diversified portfolio that aligns with your risk tolerance and long-term goals is the optimal strategy for riding out market volatility.

Ultimately, overcoming behavioural biases and staying invested for the long term offers the most promising path to achieving financial success. By sticking to a disciplined investment strategy, investors can avoid the pitfalls of emotional decision-making and build wealth over the long-term.

Source: JP Morgan as at June 2024